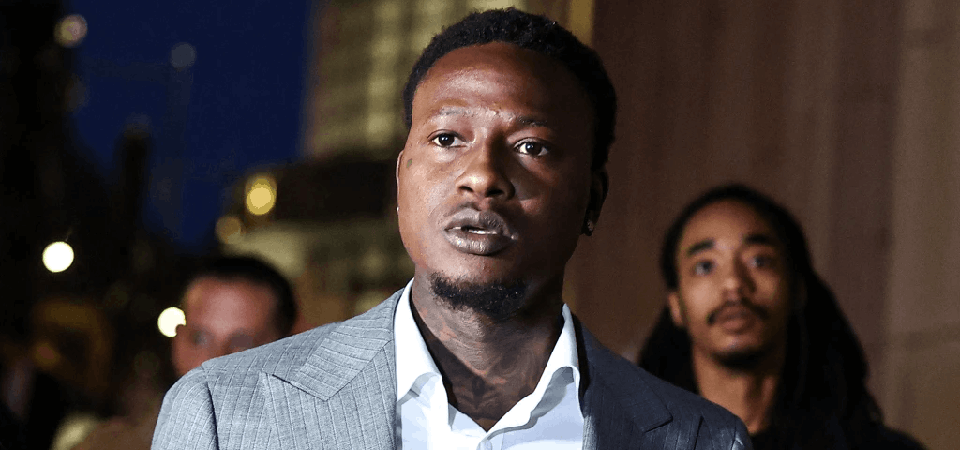

Jay Snowden, the CEO of Penn Entertainment (NASDAQ: PENN), increased his stakes by taking advantage of the casino stock's post-earnings fall.

According to a recent Form 4 filing with the Securities and Exchange Commission (SEC), on November 7, the day following Penn's third-quarter results, the CEO bought 34,700 shares of the local casino, valued at almost $500K. The gaming company also informed investors that it was terminating its partnership with ESPN Bet on the same day it issued that report.

With an average purchase price of $14.32 per share on November 7, Snowden currently owns more than 1.11 million shares of his employer's stock. The gaming stock is currently trading at about $15.40, so it seems like he was right to make that purchase. It was the first time in 13 months that he had declared a purchase of Penn stock.

Although the CEO's office did not comment on it, Snowden's acquisition of his employer's stock might be interpreted as a vote of confidence in the operator's shift to digital gaming and its regional casinos. Corporate executives frequently purchase their company's shares because they think it is cheap and ready to rise.

Investors in Penn Entertainment Continue to Criticize Snowden

To his credit, Snowden is purchasing Penn stock at a time when insider sales at other rivals are still common and some gaming executives aren't racing to purchase their companies' shares. Nevertheless, Snowden's performance as CEO has drawn criticism from investors.

Since taking over the regional casino operator at the beginning of 2020, the stock has lost over 76% of its value in the last five years, falling well short of competitor Boyd Gaming (NYSE: BYD). Boyd, situated in Las Vegas, increased by 143% over that time. Penn also trailed both broader measures of gaming companies and pure-play sports betting firms throughout that period, which isn't saying much given their lackluster performances.

Some significant shareholders criticized the board of directors for indulging the CEO's online sports betting whims and generously paying him while the stock plummeted due to Penn's declining stock price throughout Snowden's tenure.

The Donerail Group encouraged Penn to think about selling itself last year, and earlier this year, hedge fund HG Vora engaged in a proxy struggle to secure the appointment of three directors to Penn's board. Two of those candidates were successfully appointed to the board.

Leaving ESPN Bet Could Be Beneficial

Wall Street believes that an overhang has been eliminated from Penn's investing thesis after Penn ended the ESPN Bet arrangement. The operator may be able to refocus its narrative on iGaming and local casinos as a result.

The decision "derisks the Penn value story," according to a recent analysis by Macquarie analyst Chad Beynon, who rates Penn as "outperform."

“We reiterate our Outperform call given potential value if PENN can execute, but acknowledge the margin for error is razor-thin. PENN is well-positioned given recession-resilient history; we think the thesis rests on online momentum in the US/Canada,” he wrote.